coverage sr-22 insurance liability insurance no-fault insurance vehicle insurance

coverage sr-22 insurance liability insurance no-fault insurance vehicle insurance

For instance, a driver with no-DUI background paying $100 per month for auto insurance policy might get a 20% great motorist discount and also only pay $80 per month. After getting a DRUNK DRIVING, the driver will be back to paying a minimum of $100 per month, which is 25% even more than the previous price cut rate.

Note that the SR-22 insurance plan needs to provide all automobiles you possess or regularly drive. For how long do you require to have an SR-22? The size of time you'll need to preserve SR-22 relies on your conviction, which should specify how much time you're anticipated to keep the SR-22 declaring (sr22 insurance).

Maintaining continuous insurance coverage is vital. Any lapses in your SR-22 automobile insurance policy will certainly trigger your driving benefits to be put on hold once again, as your insurer would certainly file an SR-26 form with the DMV informing them of the lapse. If you vacate The golden state during your necessary declaring duration, you'll need to locate an insurer that does business in both states and also agrees to file the type for you in the state - liability insurance.

During the 10 years following a DUI, you won't be eligible for a great motorist price cut in California. Hereafter period has actually ended, the DUI will be eliminated from your driving document as well as you will be qualified for the discount rate again. You might have the ability to get the sentence gotten rid of from your document previously, but so long as you remain with the very same insurance firm, the company will learn about the drunk driving as well as remain to use it when identifying your SR-22 insurance coverage prices.

However it offers insurance coverage if you periodically drive other individuals's cars with their authorization - sr-22. For those that don't possess a vehicle, non-owner SR-22 insurance is a policy that provides the state-required responsibility insurance policy yet is linked to you as the driver, despite which vehicle you use. One of the benefits of non-owner SR-22 insurance is that quotes are typically less expensive than for a proprietor's policy, since you'll just get liability insurance coverage and the insurance company thinks you drive less regularly.

The Single Strategy To Use For What Does Sr22 Mean In Car Insurance? - Answer Financial

Approach To determine the ordinary price of SR-22 insurance coverage in The golden state, we collected statewide typical rates from 8 insurance companies: Mercury, Allstate, CSAA (AAA Nor, Cal), Farmers, Geico, Interinsurance Exchange (AAA So, Cal), State Farm and United Auto Insurance Coverage Co. (UAIC). All quotes are for minimal coverage plans for a 30-year-old male who is legitimately required to have his insurer submit an SR-22 on his behalf.

These rates were openly sourced from insurer filings and also must be utilized for relative purposes just your very own quotes might be various - insurance.

sr22 coverage division of motor vehicles division of motor vehicles division of motor vehicles motor vehicle safety

sr22 coverage division of motor vehicles division of motor vehicles division of motor vehicles motor vehicle safety

Key points to learn about SR-22 insurance prior to buying., Automobile Insurance Writer, Feb 18, 2022 - insurance coverage.

If you have an SR-22 filing in California and also want the most affordable rates, it's best to compare at the very least 3 various cars and truck insurer to guarantee you get the ideal possible bargain. SR-22 insurance coverage includes a loading price, typically a single fee of around $25. You'll no more be qualified for any type of excellent motorist discount rates, making SR-22 insurance even much more costly.

California drivers looking for insurance after a ticket or accident must look around to find reduced prices yet will not see the very same high costs as those who need to get an SR-22. Exactly how long you require SR-22 insurance coverage in The golden state depends on your conviction, yet it is 3 years - car insurance.

8 Simple Techniques For Sr22 Filing In North Dakota - Serenity Insurance

Exactly how Do You Obtain SR-22 Insurance Policy in The Golden State? Your insurance provider will certainly submit an SR-22 type with the state upon your demand. Due to the fact that risky chauffeurs are required to submit SR-22 forms, an insurer may pick not to cover you. Also if you can secure insurance policy coverage, your rates will likely be a lot greater than they were before your driving infraction.

Contrast Auto Insurance Coverage Fees, Guarantee you're getting the ideal rate for your automobile insurance policy. Contrast quotes from the leading insurance provider. Non-Owner SR-22 Insurance in California, Drivers Click for more info in California with significant website traffic violations and a suspended permit might need to file an SR-22 as well as purchase auto insurance coverage to obtain their license renewed.

Normal vehicle insurance coverage can be pricey for those who don't possess an automobile, which is why non-owner auto insurance policy is the very best option for these sorts of vehicle drivers. This permits them to show evidence of obligation insurance protection to get their license renewed as well as ensures their defense in case of another accident.

Insurers are called for to file an SR-22 type on your behalf digitally if one is required. In some instances, insurance business may choose to no longer cover you if you need an SR-22.

Just how much does SR-22 insurance coverage expense compared to a basic plan in The golden state? SR-22 insurance is rather a little bit extra pricey than a regular insurance coverage in California. insurance group. Cars and truck insurance policy costs an average of $1,857 each year for SR-22 protection because of a DUI and an average of only $643 without an SR-22 type.

How What Is An Sr-22 And When Is It Required? - Nationwide can Save You Time, Stress, and Money.

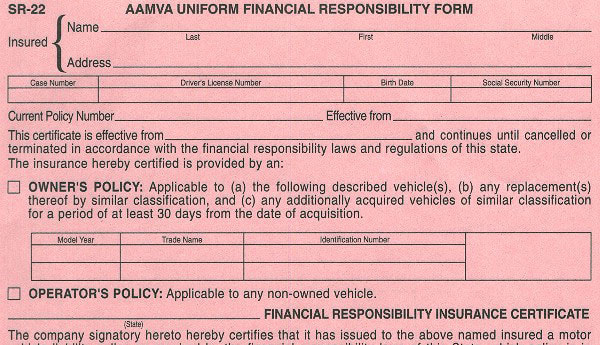

An SR-22 is a sort of form filed with the Department of Electric Motor Cars (DMV) to reveal that a chauffeur has a car insurance coverage plan effective (underinsured). SR-22s are normally required after a person's driver's license is put on hold as a result of a significant infraction like a DUI or careless driving sentence.

If you have just recently been told you need an SR-22 declaring, Bankrate can help you comprehend what you require to do, specifically what an SR-22 kind implies and also exactly how much you can anticipate your premium to enhance - underinsured. Having this knowledge could help you navigate your circumstance and also be far better gotten ready for the ins as well as outs of your SR-22 need.

sr22 coverage sr-22 insurance insure ignition interlock insurance companies

sr22 coverage sr-22 insurance insure ignition interlock insurance companies

If your driving opportunities were revoked after a major offense, you 'd need to verify that you have insurance to restore your certificate. dui. An SR-22 need means that your insurer will need to file the SR-22 form with the DMV as evidence of your insurance coverage. Each policy revival, the DMV will be upgraded that you still have coverage.

division of motor vehicles motor vehicle safety sr-22 insurance insurance driver's license

division of motor vehicles motor vehicle safety sr-22 insurance insurance driver's license

They're looking for hints that you might cause crashes that would need a claim payment. Normally, the greater threat you're taken into consideration, the more you'll pay for auto insurance policy.

The insurance coverage firm can issue the SR-22 form to the DMV. Not all insurance firms sell non-owner cars and truck insurance, however, and also not all companies submit SR-22 kinds, so you'll need to shop around to find a firm that will certainly finance you.

Getting The Faqs About Sr22 Insurance In Az To Work

This lets the DMV know that you are preserving at the very least the state's minimum required levels of protection. What occurs if I cancel my SR-22 insurance? When your insurance provider concerns you an SR-22, they're allowing the DMV know that you are currently guaranteed with a minimum of the state's minimum demands.

These are example prices as well as need to only be utilized for comparative objectives (sr22 coverage). Incidents: Prices were computed by evaluating our base account with the following incidents applied: clean record (base), at-fault mishap, single speeding ticket, single DUI conviction as well as lapse in protection.

An SR22 is an insurance certification that offers proof of economic responsibility. It is submitted by a car insurer and also proves to the that you are financially accountable and will certainly have car insurance obligation coverage. insurance. If you are called for to file an SR22 form adhering to a DUI or various other license suspension, restriction or abrogation, then you require to contact a DMV-authorized insurance firm.

The most usual circumstances when an SR22 is needed is when a vehicle driver's license has been put on hold as the outcome of a DUI. It might likewise be required if you are captured driving without insurance coverage, had your permit withdrawed or restricted or were jailed for reckless driving. bureau of motor vehicles. If you terminate your SR22 Insurance Certificate before the mandated amount of time needed by the DMV to have it on your policy, your vehicle insurance agency or broker will certainly notify the DMV as well as your license will be suspended.

We supply low-cost, budget friendly alternatives that will offer you the insurance coverage as well as assurance that you are entitled to. sr22.

See This Report on 10 Best Sr-22 Insurance Companies Of 2022 - Consumers ...

Not all insurance carriers use SR-22 filings. A DMV might call for an SR-22 from a driver to renew his/her driving privileges adhering to an uninsured cars and truck crash or sentence of another traffic-related violation, such as a DUI. An SR-22 might be required for 3 years for conviction of driving without insurance policy or driving with a suspended license and also up to five years for a DRUNK DRIVING.

SR-22 Insurance policy can only be acquired through an insurance provider. car insurance. SR-22 insurance policy has a significant influence on your rates in California, and those prices can vary substantially from one company to another. Limits for An SR-22 Insurance Coverage in The golden state At the minimum, you require the protection detailed below if you are required to have SR-22 insurance coverage in California.

The same instance puts on those who do not own a vehicle. department of motor vehicles. Non-owner cars and truck insurance is the ideal choice for those who do not possess a car considering that typical vehicle insurance coverage can be expensive. That indicates that such people will certainly be covered in case of an additional accident, and they can additionally show evidence of liability insurance policy protection to obtain their certificate reinstated.

The factor why non-owner SR-22 insurance is less costly is that the insurance provider thinks that you do not drive often, and the only protection you get, in this instance, is for liability just. If you rent out or borrow cars often, you should think about non-owner auto insurance policy also - insurance. Prices can vary throughout insurance companies, the average yearly expense for non-owner automobile insurance coverage in California stands at $932.

dui vehicle insurance insurance group auto insurance ignition interlock

dui vehicle insurance insurance group auto insurance ignition interlock

Demands for An SR-22 in California First, understand that an SR-22 affects your automobile insurance policy expense and also protection. For circumstances, after a DUI conviction in California, common vehicle drivers pay approximately 166% greater than vehicle insurance coverage for SR-22 insurance policy. The minimum duration for having an SR-22 in California is 3 years, but one may need it longer than that, relying on their case and offense.

The smart Trick of Financial Responsibility Affidavits - Tn.gov That Nobody is Discussing

In any one of these circumstances, an SR-26 form can be submitted by your insurance firm. When that occurs, your insurance firm ought to indicate that you no more have insurance coverage with the entity. Starting the SR-22 procedure over once more will certainly be needed if your firm files an SR-26 prior to completing your SR-22 demand (insurance).

MIS-Insurance deals economical SR22 insurance coverage that will save you cash over the life of your plan. Inexpensive SR22 insurance policy is offered as well as we will certainly can help you secure the ideal policy for you.

A drunk driving will immediately increase your rates without considering extra price boosts and deny you price cuts even if you were formerly getting a great chauffeur price cut. Instead of paying $100 month-to-month for car insurance coverage, a chauffeur with no DUI background will just pay $80 month-to-month, thanks to the 20% great motorist price cut they obtain.